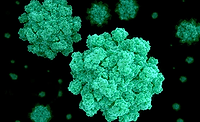

Covid-19 outbreak could spur flexible packaging use in China

The outbreak of the coronavirus in China could spur increased usage of flexible packaging to improve food safety, according to Brendan Connell-French, Wood Mackenzie research associate.

"While efforts to limit the spread of Covid-19 are ongoing, attentions are also focused on measures to reduce the risk of future outbreaks. With the spotlight falling on food supply chain health and safety, this could drive new demand for flexible packaging in China," he writes.

"The coronavirus outbreak is reportedly thought to have started at a wholesale seafood and meat market in Wuhan. These 'wet markets' can be a breeding ground for the spread of animal-borne diseases and viruses. In response to the risk, the Chinese government is reportedly considering a change to meat handling and distribution practices, and tighter regulations could lie ahead. And in our view, such a change would likely result in increased demand for flexible packaging.

"China currently has a very low consumption per capita of flexible packaging for fresh and processed meat and seafood, compared to Japan, the US and Western Europe. An increase in consumption could play a role in reducing the risk of a future outbreak. Distributing meat in flexible plastic packaging offers a host of advantages over live on-site butchering, including improved sterilization, tracing and recall, as well as extended shelf life.

"However, wet markets are an integral part of Chinese life. Local preference for freshly butchered meat won’t evaporate overnight, even with a strong government stance. To date, even major multinational retailers, such as Walmart, have been unable to improve their low market share in China’s fresh meat sector, despite their growing local presence, Connell-French says.

"But while the likelihood of wholesale changes in purchasing habits remains low, a public health crisis of the nature and magnitude of the coronavirus outbreak could spark a change in tastes and preferences.

"Flexible packaging demand in Asia has been hit by a sluggish regional economy, growing by 4.8% in 2019 – down from 5.6% in 2018. Chinese per capita consumption of flexible packaging for fresh and processed meat and seafood is currently so low that even subtle shifting of production to larger corporations (who will use more packaging in distribution) could have an impact on growth.

"In our view, we’re unlikely to see a complete change in meat purchasing preferences in China. But the coronavirus outbreak could stimulate a redesign of wet markets and start to alter the landscape for fresh meat and its distribution.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!