Evolving Food Safety Practices in Response to Growth in Fresh Prepared Foods

Shelf life and food safety have emerged as key decision factors for retailers when selecting producers of their fresh prepared foods products

Video credit: monticelllo/Creatas Video+/Getty Images Plus via Getty Images

Fresh prepared foods (FPF) is a catch-all term for convenient grab-and-go and deli items that are sold at grocery stores—typically ready-to-eat (RTE) or ready-to-cook items (e.g., pre-marinated, pre-seasoned). FPF was a large and high-growth market prior to the pandemic, with sales in the U.S. accelerating 7–10%+ year-over-year during the decade before COVID-19.1 The market benefited from increased consumer trial during COVID-19 as restaurants shut down and Americans searched for convenient products at their local grocery stores. Post-pandemic, demand has remained strong for these items, and grocery stores are investing in the FPF section of the store. This is driving an increased focus on, and need for, food safety for FPF.

Fresh Prepared Foods Market Definition

FPF includes a variety of product types (see Figure 1) that meet different consumer needs. This market includes branded, packaged, ready-to-eat (RTE) products, also known as "home meal replacement," hot bar and deli (behind-the-glass) products, deli meats and cheeses, un-branded prepared meals, soups, dips, and even in-store bakery items.

Most full-service grocery stores have a well-established FPF section, which is accessible to those stocking their pantries as well as those coming in to use the "grocerant" section of the store. A grocerant often has tables for dining and in-store restaurants for sandwiches, pizza, stir fry, sushi, and other items. These mini-restaurants are sometimes managed by the grocery retailer themselves and sometimes outsourced to a third-party operator/chef.

Regardless of their current footprint, U.S. supermarket owners indicate that FPF is an area they are focused on investing in for growth. FPF is a great way for retailers to differentiate from other brick-and-mortar grocers and also to defend against online players. While Amazon can deliver groceries to your door, it cannot provide a fresh, hot, prepared meal that is ready to eat. A fresh, hot, prepared meal keeps the store footprint relevant and drives traffic by creating a destination for consumers. Grab-and-go items are seeing particularly high demand. According to a recent study by Supermarket News, 66 percent of retailers suggested that grab-and-go products are the best way to compete for prepared foods sales.2

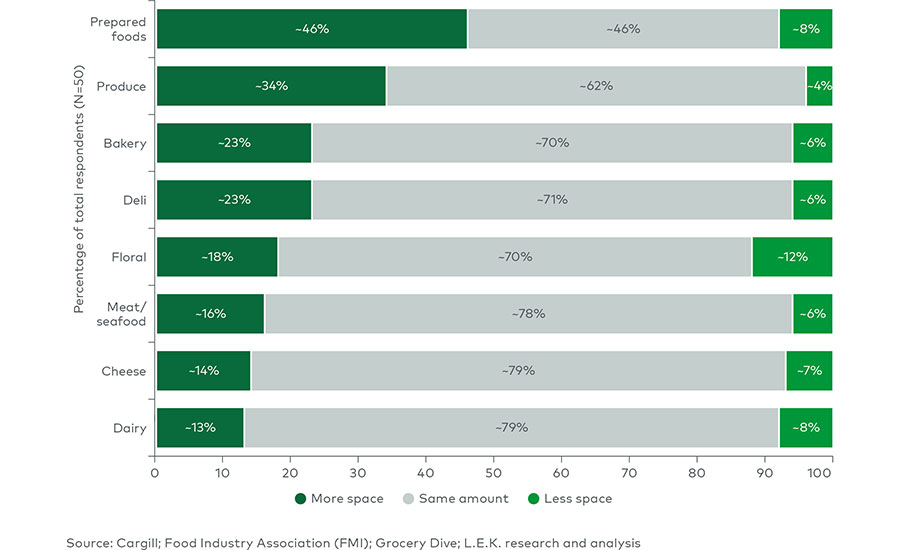

In a survey of food retailers conducted by Supermarket News, "prepared foods" stood out as the number-one area where they are planning to devote more space (see Figure 2).3 FPF has been a consistent priority for many retailers in the past few years, especially coming out of the COVID-19 pandemic.

Retailers are investing in FPF because it is a win-win for the retailer and the consumer. These products are often higher-margin than center-aisle goods, bring new consumers into the store, help the store differentiate, and can even help reduce shrink if retailers are producing FPF items in-store. For example, some retailers will take a raw chicken breast that is about to expire, and rather than discounting it to sell, they will cook it for use in FPF products or in the grocerant section of the store.

For their part, consumers value FPF because the foods offer convenience (quick and easy meals) and a chance to extend beyond their cooking comfort zone. FPF help them overcome the "comfort barrier" to cooking with new flavors at home. With FPF, consumers can try a globally inspired marinade or a new cuisine, with relatively little effort in the kitchen at home. This is particularly relevant for those working from home who are looking to replace a restaurant meal or grab-and-go meal near the office for lunch.

Shelf Life and Food Safety—Key Retailer Needs for FPF Producers

Retailers have expressed commitment to additional investments in FPF, which will require producers to keep pace. Shelf life and food safety have emerged as key decision factors for retailers when selecting producers of their FPF products.

The FPF producer landscape is quite fragmented today, with retailers sourcing from a patchwork supply network. A national supplier that provides quality and consistency at scale is ideal, but less common, today. Most suppliers operate regional models, shipping refrigerated or frozen products within a set radius. Others act as commissaries, with facilities dedicated to a handful of key accounts.

FPF producers tend to focus on specific categories, like deli salads or ready-to-cook and RTE meals, but expand as they scale. For example, Blount Fine Foods and Kettle Cuisine both started in premium refrigerated and frozen soups but added adjacent products to continue driving growth.

Across product categories, shelf life is a key decision factor for retailers. Shorter-shelf-life products limit the delivery radius of an item and add operational complexity, which can challenge profitability. Longer-shelf-life items can be shipped farther, making them more appealing to retailers due to reduced risk of shrink and generating production efficiencies in the form of longer runs.

Shelf life is also important to suppliers because of its relationship to food safety. Longer-shelf-life items are at a lower risk of product expiration, and thus help reduce food safety concerns that often exist with shorter-shelf-life products. Next, strategies will be explored that can be implemented both during the in-facility production process, as well as in-store, to mitigate food safety concerns for FPF.

In-Facility Food Safety Strategies

Most producers utilize specific technologies and/or preservatives to extend product shelf life. Preservatives are a relatively simple way to extend shelf life but suffer from negative perception by some retailers and consumers. Given this, many producers are increasingly turning to high-pressure processing (HPP), modified atmosphere packaging (MAP), and frozen shipping to extend shelf life. Many of these technologies also have a kill step that increases food safety and enables a clean label claim that appeals to consumers.

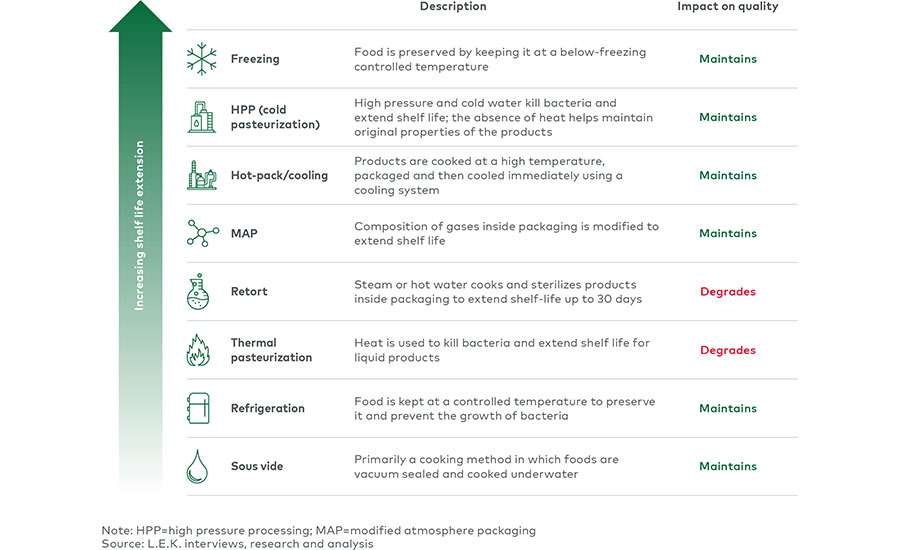

Products with short shelf lives provide a unique challenge that is necessary to address. To manage these products properly and compete effectively, producers need expertise in procurement, distribution, and operations. For short-shelf-life products that cannot utilize preservatives (e.g., to maintain natural claims), other technologies can be leveraged (e.g., retort, HPP, and shipped frozen) to extend shelf life in a food-safe way, better serving national retailers with quality and consistency at scale (see Figure 3).

A number of strategies are available for safely utilizing these shelf-life extension processes.

High-Pressure Processing

HPP is a popular method for increasing shelf life while preserving product quality, utilizing a combination of high pressure and cold water to kill bacteria in food. However, it is not an appropriate process for all food types. HPP is best suited for products that have a water activity ratio above 0.96. This is because these products have a higher content of water available to transmit the pressure, enabling greater microbial inactivation.4 Similarly, acidic foods (pH < 4.6) are good candidates for HPP.5 Suitable products for HPP include products such as deli meat, guacamole, RTE meals, and sauces. On the other hand, dry spices, jam, concentrated juice, syrups, and condensed milk are examples of products that are unsuitable for HPP. Before using HPP, producers must evaluate whether the technique is appropriate for the product.

During HPP, food and packaging material may undergo a 15 percent volume reduction before returning to their original volume under depressurization. Thus, the packaging must be flexible enough to withstand the volume reduction. For this reason, HPP products are typically vacuum-packaged using flexible pouches or containers. Rigid containers, such as glass bottles or tin cans, are unsuitable for HPP as they cannot effectively transmit pressure to the food product. Given that HPP products are immersed in water, packaging must also be water-resistant and hermetically sealed with a lidding film to prevent water from leaking into the product. As consumers must open this film to consume the product, the film must be strong, but not too tight.5

One company has developed a new packaging technology consisting of color-changing ink that darkens as HPP pressure is applied. Experts anticipate that retailers will begin to require the use of this technology as it can verify that a product has successfully undergone HPP.6 Thus, these technologies may become the standard in the future. Ultimately, food safety professionals must invest in packaging that can survive the unique rigors, limitations, and demands of the HPP process.

Modified Atmosphere Packaging

Another common production processing technique is MAP, which works by altering the composition of the air around the food product, establishing an environment that slows down spoilage and prolongs the product's shelf life. While MAP is a powerful technique, food packagers must verify the gases inside the packaging and confirm that the seal is not broken. Packagers must use a trace oxygen analyzer to verify the level of oxygen inside the packaging and ensure the packaging seal is on properly.7

If the hermetic seal of a MAP package is compromised, oxygen and moisture may enter the package and deteriorate the product. Additionally, if the MAP gas concentration is not suitable for the particular product, then degradation can occur. It is crucial to regulate the gas mixture, monitor the composition of the MAP gas, and regularly inspect MAP products for leaks to ensure they reach end users in the intended condition.8 Some manufacturers have created custom formulations for MAP gas that gives them a differentiation in shelf life and product quality. Food safety professionals should carefully evaluate the benefits and risks of this packaging technology when building out FPF capabilities.

In-Store Food Safety Strategies

While it is crucial that FPF are produced safely in the processing facility, their in-store treatment is just as important. Many retailers produce FPF in-house by using products that are close to the end of their shelf life. For example, rather than discounting a chicken breast to sell it shortly before its expiration date, a retailer may cook it and use it in a soup or prepared meal to serve onsite in the FPF section. As such, careful attention also needs to be paid to sound food safety practices in-store.

In-store food safety practices can largely be categorized into practices around hygiene, temperature control, food organization, and education.

Hygiene

The U.S. Department of Agriculture (UDSA) recommends that employees wash their hands adequately, put on single-use gloves after handwashing, and practice good personal hygiene to reduce contamination on food contact surfaces and in food.9 Employees should clean and sanitize frequently to prevent the creation of insanitary conditions and the adulteration of product, per USDA's Food Safety and Inspection Service (FSIS) guidelines.9

Temperature Control

It is important to know the minimum safe internal temperature for all proteins outlined by FSIS. When reheating cooked food, it must reach a minimum temperature of 165 °F (74 °C). Employees must keep track of how long a product has been refrigerated or set out, and discard it once it is outside the safe window. This is particularly important for FPF, which may be prepared and then set out for ease of grab-and-go purchasing.

Food Organization

Many foodborne illnesses arise because of cross-contamination from raw meat or poultry to other foods. Employees must keep raw produce, meat, poultry, seafood, and eggs separate, and use different cutting boards, utensils, and meat thermometers for each. It is important to label food with its date of arrival and date of expiration to ensure that no expired food is used. For multi-ingredient dishes, like a prepared meal, keeping track of all ingredient life spans is particularly important.

Education

All staff must be properly trained to ensure that all food safety standards are met. FSIS advises retail deli operators to prioritize high-quality training and active management involvement with the aim of preventing and minimizing the incidence of foodborne illnesses.9

The strategies detailed above will greatly contribute to improving food safety in FPF. Food safety professionals should also frequently assess the operations in their facilities to ensure that food safety standards are consistently met and keep up to date with best practices for food safety.

Future of FPF—More Opportunity to Come

Despite recent growth, the FPF market in the U.S. remains underdeveloped relative to international markets. Retailers in Europe have much better FPF offerings—a trip to a Tesco grocery store in London during the weekday lunch rush will find you surrounded by people deciding which affordable lunchtime "meal deal" they should try that day. Offerings range from ready-to-eat traditional British fare to ethnic meals to premium soups and salads. Compared with the U.S., penetration of RTE meals is much more robust in the UK.

The FPF market—high off several years of growth due to the pandemic and an increasingly busy consumer demographic—is expected to continue to expand, creating massive opportunity for producers and retailers. As the production of FPF continues to grow, it is imperative that food safety remain the top priority in all facilities. Poor food safety practices can lead to foodborne illness for consumers and can create negative associations with FPF.

The long-term success of FPF is dependent on consumers' confidence that the foods are safe to eat. Thus, workers in grocery stores and production facilities must strive to follow food safety guidelines to ensure the well-being of consumers. With applied attention to considerations like shelf life, food safety, product categories and development, channel strategy, and automation investment, companies in FPF production face an open door of growth possibility.

References

- Craigwell-Graham, J., R. Wilson, and C. Morgan. "Finding Success with Fresh Prepared Foods." April 17, 2023. https://www.lek.com/insights/con/us/ei/finding-success-fresh-prepared-foods.

- Browne, M. "2022 Supermarket News Fresh Food Trends Report: Shoppers are back in stores and still eating more at home." June 15, 2022. https://www.supermarketnews.com/consumer-trends/2022-supermarket-news-fresh-food-trends-report-shoppers-are-back-stores-and-still.

- Wilson, B. "2023 SN Fresh Food Trends Survey." June 9, 2023. https://www.supermarketnews.com/consumer-trends/2023-sn-fresh-food-trends-survey.

- "Products not suitable for High Pressure Processing (HPP)." Hiperbaric. July 23, 2021. https://www.hiperbaric.com/en/products-not-suitable-for-high-pressure-processing-hpp/.

- Janahar, J.J. and V.M. Balasubramaniam. "Application of High-Pressure-Based Technologies in the Food Industry." Ohio State University. November 1, 2022. https://ohioline.osu.edu/factsheet/fst-fabe-1001#:~:text=Like%20any%20other%20processing%20method,difference%20between%20air%20and%20food.

- Riley, S. "Inks ensure HPP properly applied." Pro Food World. June 7, 2019. https://www.profoodworld.com/home/article/13279888/inks-ensure-hpp-properly-applied.

- "What is Modified Atmosphere Packaging?" CO2Meter. April 3, 2023. https://www.co2meter.com/blogs/news/modified-atmosphere-packaging.

- "What is Modified Atmosphere Packaging (MAP)?" Ametek Mocon. https://www.ametekmocon.com/knowledge/learnaboutmodifiedatmospherepackagingmap/whatismodifiedatmospherepackagingmap.

- U.S. Department of Agriculture Food Safety and Inspection Service (USDA FSIS). "FSIS Best Practices Guidance for Controlling Listeria monocytogenes (Lm) in Retail Delicatessens." June 2023. https://www.fsis.usda.gov/sites/default/files/media_file/documents/FSIS-GD-2023-0004.pdf.

Claire Morgan is a Partner and Managing Director with L.E.K. Consulting in Boston, Massachusetts. She is one of the leaders in the Retail and Consumer practice, with a particular focus on fresh prepared foods. Claire spoke recently at the Seafood Expo about opportunities in value-added seafood specifically and has expertise working across ingredient and protein types.

Justin Craigwell-Graham, M.S.F., is a Partner and Managing Director with L.E.K. Consulting in Los Angeles, California. He is one of the leaders in the Food and Beverage practice, with deep experience in fresh prepared foods. Justin has led multiple engagements focused on shelf life-extending technology and food safety.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!